Increasing focus on emissions from the insurance exposure

The insurance industry is in an ideal position to foster the global transformation to net-zero greenhouse gas (GHG) emissions. This comes from the fact that insurance companies are large asset owners, can select what types of risks they cover, and have much to say about how properties and vehicles are repaired.

Previously insurers have mainly been focused on reducing emissions that stem from their own operations and from their investment portfolios. Now, the trend is to focus on the insurance exposure.

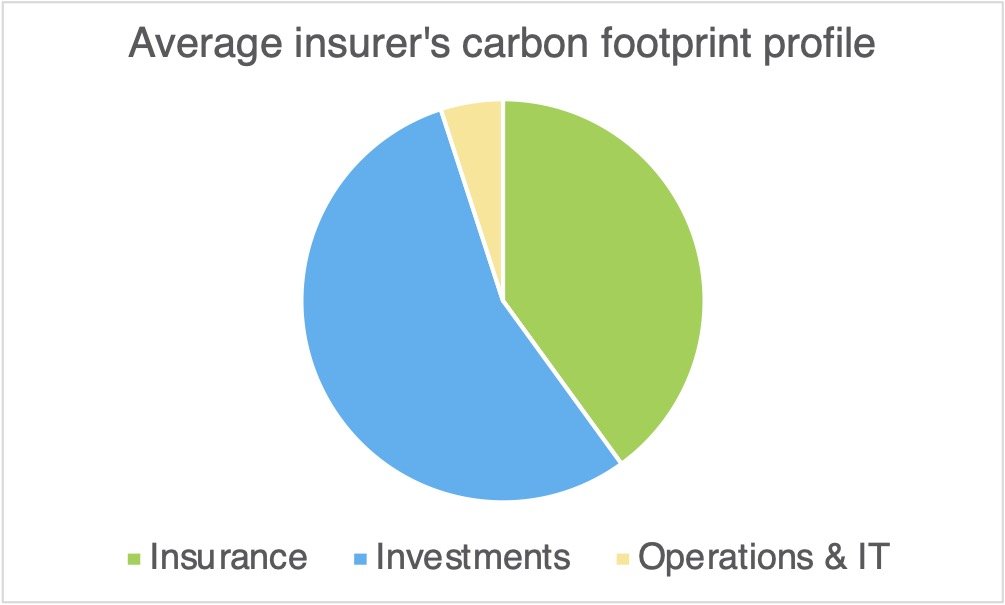

According to a recent publication by the Boston Consulting Group (BCG), the insurance exposure amounts on average to 35-40% of all emissions that an insurer accounts for. This is very much aligned with our own calculations and estimates at Claims Carbon.

As is typical for most service companies, the share of own operations (e.g. business travel, waste, IT purchases etc.) accounts for only 1-5% of all emissions.

A clear indication of the increased focus on the insurance exposure is the Net-Zero Insurance Alliance (NZIA), which now consists of over 20 leading insurers representing more than 11% of world premium volume globally. Several insurers have also started to publicly disclose ambitious emission reduction targets in their claims handling processes.

The claims handling processes are an important part of the insurance exposure, because according to our calculations, repairs and replacement of insured assets amount to circa 1% of all global GHG emissions.

As with any business area with a climate impact, the insurance exposure will also require a net-zero strategy. BCG outlines three main steps in building such a strategy for insurers:

- Set a baseline. This means understanding the current situation across all three areas of the climate triangle. Specifically for the insurance exposure, it means analyzing the underwriting portfolio to see if an insurer is overweight in high-carbon sectors and understanding the carbon hotspots in claims handling processes.

- Define targets. What’s measured, gets done, and scenario modeling will be important when assessing the gap between the current situation and the desired future state. It’s not only about planning how emissions could be reduced, but also about how much new business an insurer can capture by adopting a net-zero strategy.

- Take action. Finally, by understanding what needs to be done and how value can be created, insurers can take action and start working with their underwriting portfolios and claims handling processes. In claims management, repairing instead of replacing could significantly help lower emissions and costs, since reusing parts from similar vehicles is less expensive than sourcing original parts and comes with a positive climate impact.

To summarize, insurance companies are well positioned to contribute in the global combat against climate change and it is encouraging to see that the insurance exposure – which stands for a large portion of the total emissions of an insurer – is receiving more and more attention.

We're also pleased to notice an increased interest among insurers towards the Science Based Targets Initiative (SBTi), which shows how much and how quickly an insurer needs to reduce emissions to be in alignment with the Paris climate agreement. Target setting and scenario modeling is also emphasized by the Task Force on Climate-Related Financial Disclosures (TCFD), a set of financial risk disclosures created in 2015 by the Financial Stability Board that now applies to most banks and insurers.

Data is key when calculating a baseline and defining targets. While it is expected that many service and software providers will emerge in the field, there are currently only a few that can help insurers analyze e.g. if they’re using the right materials and processes to repair policyholders’ claims.

We at Claims Carbon develop cutting-edge software and services that help insurers in their net-zero strategy work and look forward to collaborating with leading insurers and other stakeholders in this important effort to decarbonize insurance.

Image credit: Alexander Popov @ Unsplash