Forerunners in the insurance industry are taking climate action

Insurance companies have for some time understood the extent of physical climate risks and their impact on the industry. Also, they are increasingly recognizing the carbon footprint of their own value chain. All dimensions of the insurance business must be urgently reviewed to avoid the worst effects of climate change and to ensure that the industry does its part in our collective journey towards net zero.

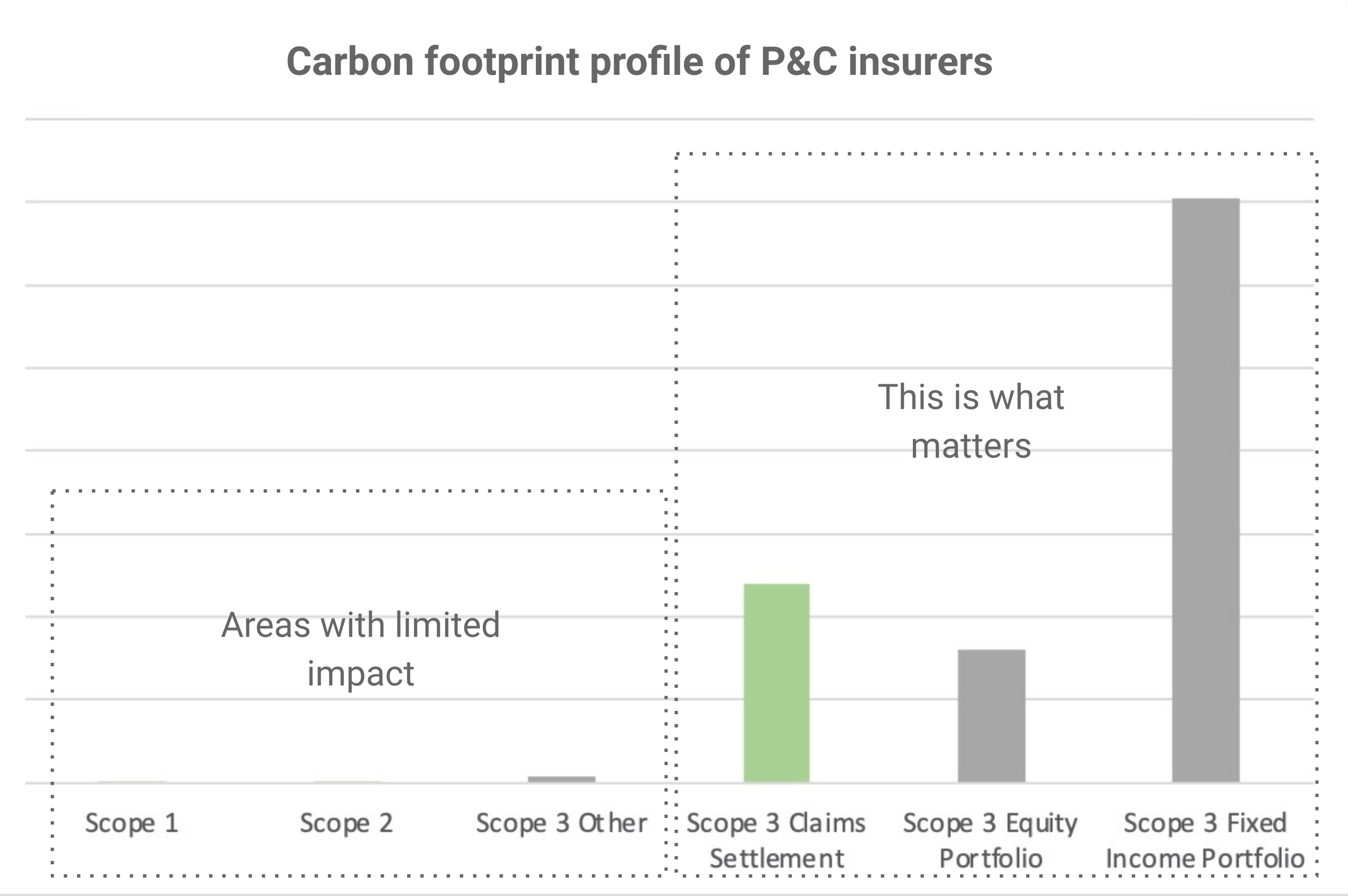

Actions that actually matter

For a typical property and casualty (P&C) insurance company the dominant insurance lines will be motor and property. It means that when looking at the carbon footprint arising from claims settlement, the largest contribution will come from vehicle and property repairs. Due to the size of the insurance industry, emissions linked to motor and property insurance claims alone are estimated to be about 1% of all global emissions – a much larger share than one would perhaps initially imagine. Sustainable claims handling is rapidly becoming a focus area within the industry.

Insurance companies are also large asset holders and as such they must pay attention to the carbon footprint stemming from their investment activities. Making asset allocation decisions that are in alignment with sustainable finance goals is critical, and fortunately an area where insurance companies have been active already for several years.

The third area where significant climate impact can be made is insurance underwriting. Insurance companies are increasingly starting to analyse their “insured emissions”, or the carbon footprint of the companies for which they provide insurance cover. These analyses are in turn leading to changes in underwriting policies and pricing. It will become increasingly difficult (or at least very expensive) to obtain insurance cover for polluting businesses.

The Net-Zero Insurance Alliance

A recent development in the insurance industry is the UN-convened Net-Zero Insurance Alliance (NZIA), consisting of several leading insurers and reinsurers, which is committing to transition their insurance and reinsurance underwriting portfolios to net-zero emissions by 2050.

The alliance members recognize that the insurance industry has a key role in supporting the transition to a net-zero economy. NZIA members will individually set science-based intermediate targets every five years and independently report on their progress publicly on an annual basis.

Nordic insurers are also stepping up

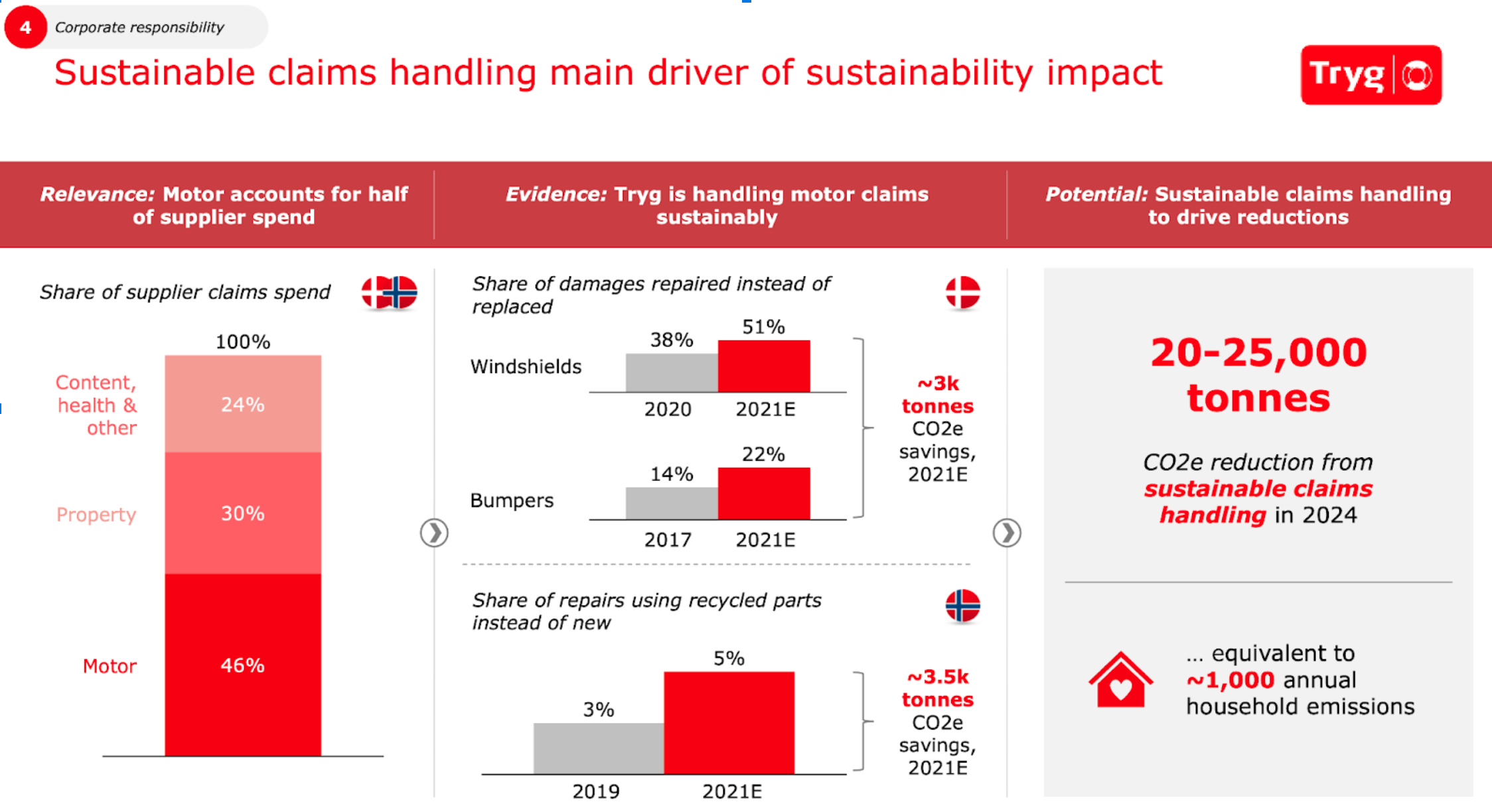

It’s encouraging to see that some of the Nordic P&C insurance companies are also showing leadership by disclosing ambitious CO2e reduction targets. What’s particularly interesting is to see how these forerunners are now turning their attention to emissions related to claims handling, i.e. “claims carbon”.

Tryg has communicated that they will reduce 20-25,000 tonnes of CO2e in 2024 by actions related to sustainable claims handling. These actions include using recycled parts instead of new ones and repairing various vehicle parts (e.g. windshields and bumpers) instead of replacing them.

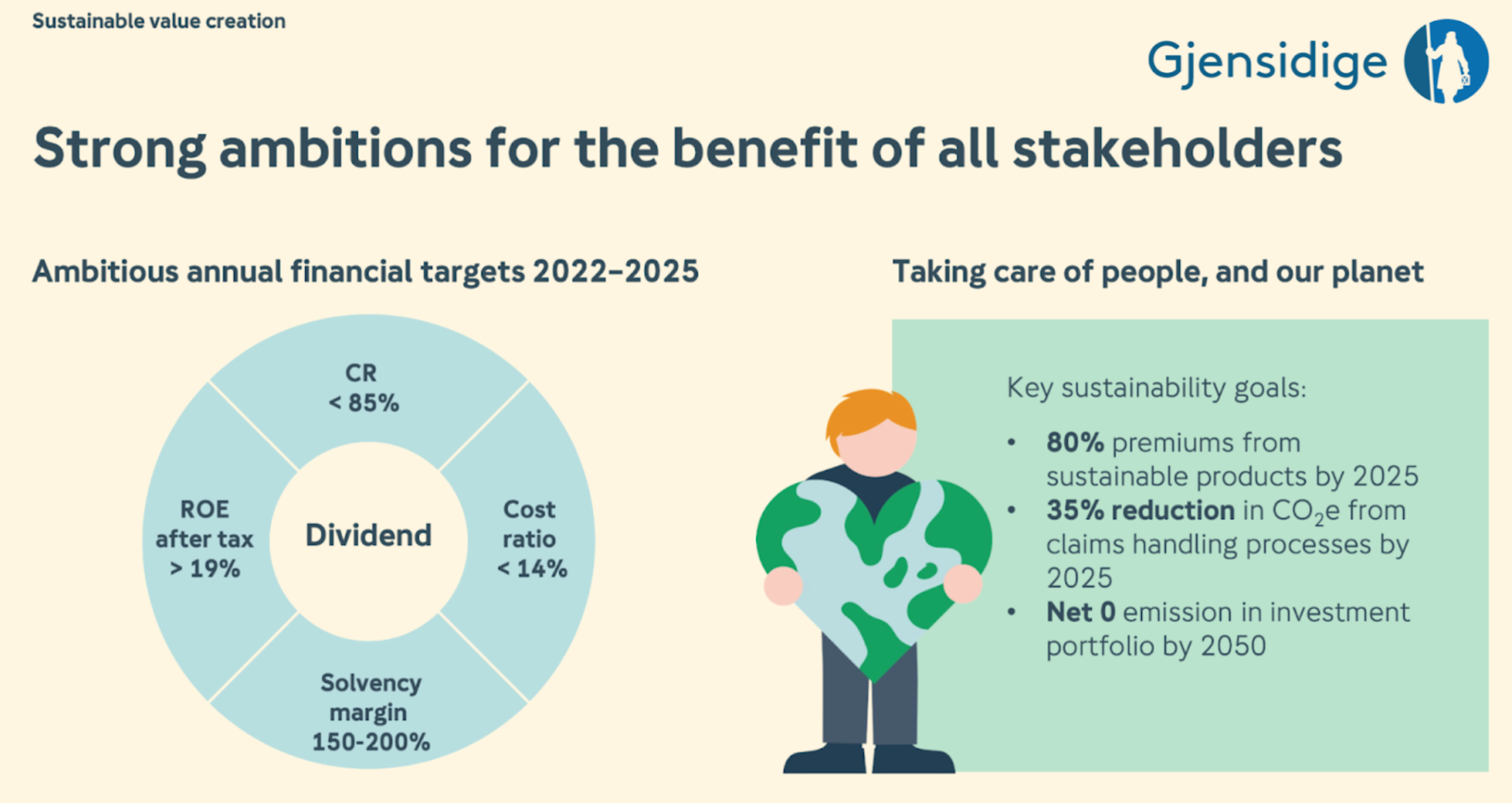

Gjensidige has also looked at its claims settlement supply chain and established that they want to achieve a 35% reduction in CO2e emissions from their claims handling by 2025. They have also communicated other climate related goals, such as collecting 80% of their insurance premiums from sustainable products by 2025.

Another large Nordic insurance company, If announced in October 2021 they believe everyone must contribute to fulfilling the Paris Agreement and that’s why they raised their ambitions and committed to the Science Based Targets initiative (SBTi).

SBTi is considered an ambitious form of corporate climate action and If’s aim is to continually reduce its own emissions to support the transformation to a low-carbon society and to encourage partners and customers to reduce theirs.

More insurers should jump on board

Given the challenges the world is facing in reaching net zero, it’s great to see that many large insurance companies are showing leadership and setting strong examples by disclosing ambitious climate goals.

The world has approximately ten years to halve global greenhouse gas emissions before we reach 1.5°C of global warming, beyond which scientists warn that dangerous impacts will kick in. This reduction will not be possible unless all financial institutions join the effort.

Besides being “the right thing to do”, having a laser sharp focus on CO2e emissions across the entire value chain makes perfect business sense. Forerunners will be in a unique position to meet the needs of stakeholders and attract new customers through public disclosure of emissions, progress toward climate targets, and demonstration of environmental stewardship.

Featured image credit: Juliane Liebermann @ Unsplash